Press release: Fees easily rank as the top payments challenge small businesses face

December 5, 2024

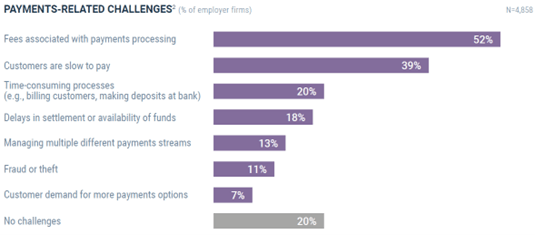

By far the most common payments-related challenge facing small businesses is processing fees – especially for retailers and others that take payment at the time of sale.

But firms that take payment after delivery are more likely to have challenges with slow-paying customers, according to the 2024 Report on Payments, released today by the 12 Federal Reserve Banks.

The report, based on the 2023 Small Business Credit Survey, details the forms of payment different types of firms accept, their typical payments terms and arrangements, and the payments-related challenges they face.

Other findings in the report:

- 38% of firms said they collect payment at the time of service or purchase, the most common payment arrangement.

- Checks and card payments (including digital/mobile payments) are the most commonly accepted forms of payment.

- Challenges with time-consuming payments and delays in settlement or availability of funds are most frequently experienced by firms paid through a third party.

The report includes data from 4,920 employer firms that responded to payments-related questions in the national survey, which was conducted between September and November 2023.

Read the report: 2024 Report on Payments: Findings from the 2023 Small Business Credit Survey

Questions? Contact Chuck Soder: chuck.soder@clev.frb.org, 216.672.2798

About the Small Business Credit Survey

The Small Business Credit Survey (SBCS) is an annual survey of firms with fewer than 500 employees. The SBCS sample includes employer firms, defined as those with 1–499 employees, and nonemployer firms, defined as those with no paid employees except the owner(s). Respondents are asked to report information about their business performance, financing needs and choices, and borrowing experiences. Responses to the SBCS provide insights on the dynamics behind lending trends and shed light on various segments of the small business population. The SBCS is not a random sample; results should be analyzed with awareness of potential biases that are associated with convenience samples. For detailed information about the survey design and weighting methodology, please visit fedsmallbusiness.org/our-data/methodology.