Press release: Some small businesses struggle with debt burden from COVID-19 EIDL loans

August 20, 2024

Small businesses that have yet to pay off COVID-19 Economic Injury Disaster Loans are in worse shape than other small businesses, according to a new Small Business Credit Survey report from the 12 Federal Reserve Banks.

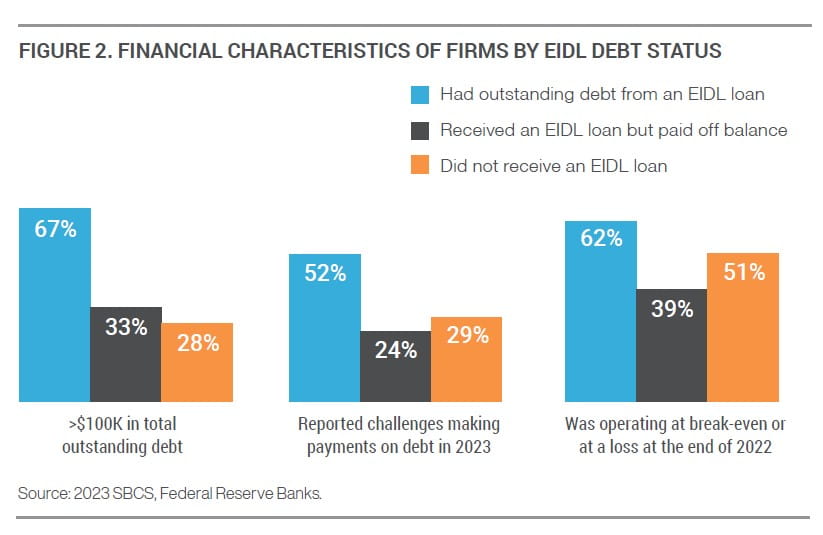

Firms with outstanding EIDL loans had higher debt levels, were more likely to report challenges making payments on debt and were less likely to be profitable as of fall 2023, when the survey was conducted. Those effects persist even when controlling for factors like firm age, industry, and credit risk.

Firms with outstanding EIDL debt also were more likely to be partially or fully denied when applying for additional credit. Half said they were denied for having too much debt.

Some firms, however, said the loans were important to their survival, and it’s unclear whether firms with outstanding EIDL loans were in worse shape from the start.

The US Small Business Administration awarded about 4 million loans worth $380 billion through the COVID-19 EIDL program. More than $300 billion remained outstanding as of late 2023. Unlike Paycheck Protection Program loans extended during the pandemic, EIDL loans are not eligible for forgiveness.

Read the report: From short-term relief to long-term hardship: Some small businesses struggle with debt burden from COVID-19 EIDL loans

Questions? Contact Chuck Soder: chuck.soder@clev.frb.org, 216.672.2798

About the Small Business Credit Survey

The SBCS is an annual survey of firms with fewer than 500 employees. These types of firms represent 99.7% of all employer establishments in the United States. Respondents are asked to report information about their business performance, financing needs and choices, and borrowing experiences. Responses to the SBCS provide insights on the dynamics behind lending trends and shed light on various segments of the small business population. The SBCS is not a random sample; results should be analyzed with awareness of potential biases that are associated with convenience samples.

Fielded September through November 2023, the most recent SBCS was the fourth conducted since the COVID-19 pandemic began in early 2020. The 2023 SBCS yielded nearly 11,000 responses from a nationwide convenience sample of small firms across all 50 states and the District of Columbia, including 6,131 responses from employer firms with 1–499 full- or part-time employees. The remaining responses represent nonemployer firms, or those with no employees other than the owner(s).