Press release: Startups much more likely to report growth than older small businesses

December 4, 2024

Most startups are operating at a loss, but they are much more likely than older small businesses to report recent revenue growth, and to expect more growth over the next 12 months, according to the 2024 Report on Startup Firms, released today by the 12 Federal Reserve Banks.

The report, based on the 2023 Small Business Credit Survey, explores the differences between startups and older firms, as well as firms with and without employees. It includes dozens of charts providing insight on business performance, challenges, and their experiences seeking financing.

More key findings:

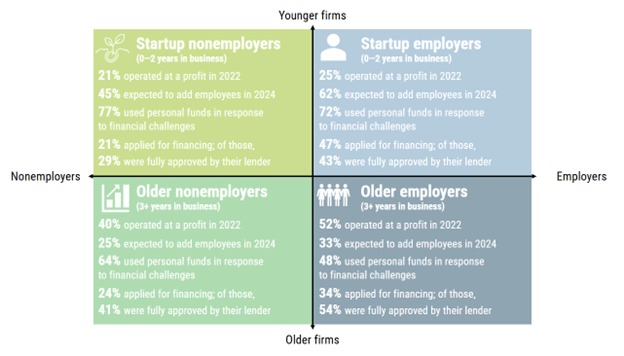

- Adding employees: 45% of nonemployer startups and 62% of employer startups expect to add employees in the coming year.

- Seeking financing: Startups without employees are less likely to have financial services relationships and use financing and credit products. By contrast, startups with employees are far more likely to seek financing than other firms.

- Getting approval: Nonemployer firms were less likely to be approved for financing than employer firms, and startup employers were less likely than older firms to be fully approved. Startups also were more likely to have received funds from their owners.

By the numbers:

The report includes data from 6,131 employer firms and 4,859 nonemployer firms. The survey was fielded from September through November 2023.

Read the report: 2024 Report on Startup Firms: Findings from the 2023 Small Business Credit Survey for New Nonemployer and Employer Firms

Questions? Contact Chuck Soder: chuck.soder@clev.frb.org, 216.672.2798

About the Small Business Credit Survey

The Small Business Credit Survey (SBCS) is an annual survey of firms with fewer than 500 employees. The SBCS sample includes employer firms, defined as those with 1–499 employees, and nonemployer firms, defined as those with no paid employees except the owner(s). Respondents are asked to report information about their business performance, financing needs and choices, and borrowing experiences. Responses to the SBCS provide insights on the dynamics behind lending trends and shed light on various segments of the small business population. The SBCS is not a random sample; results should be analyzed with awareness of potential biases that are associated with convenience samples. For detailed information about the survey design and weighting methodology, please visit fedsmallbusiness.org/our-data/methodology.