2023 Report on Nonemployer Firms: Findings from the 2022 Small Business Credit Survey

The Small Business Credit Survey (SBCS), a collaboration of all 12 Federal Reserve Banks, provides timely information about small business conditions to policymakers, service providers, and lenders. Fielded September through November 2022, the most recent survey reached nearly 6,000 nonemployer small businesses, which are firms with no paid employees except the owner(s). The SBCS collects information about the performance, challenges, and credit-seeking experiences of firms across the United States.

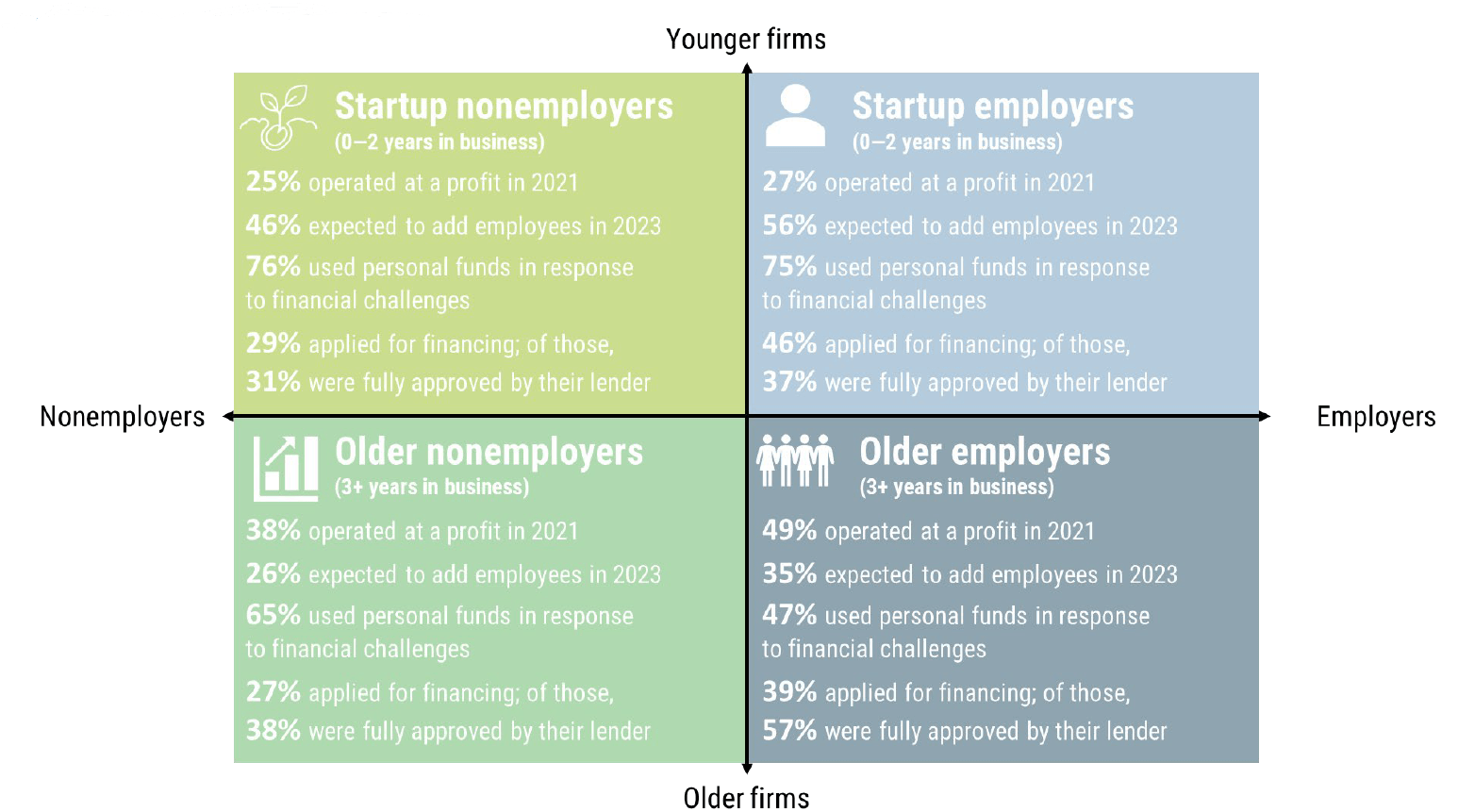

The SBCS provides helpful insights on firms in different stages of the business life cycle—from small startup nonemployer firms to well-established employer businesses. This report focuses on the nonemployer businesses, exploring differences between startups and older firms and between nonemployer and employer businesses.

Key Findings

- Almost half (46 percent) of startup nonemployers—those in business 0 to 2 years—plan to add employees in the next 12 months. A majority of startup nonemployers are not yet profitable, but they often report revenue growth and expect revenues to increase in the future. These firms have fewer financial challenges than older firms but are more reliant on the owner’s personal funds when addressing those challenges.

- As startup nonemployers mature, some remain without paid employees. These older firms are more profitable than startup nonemployers, but they report less revenue growth. These firms rely less on funds from the owner and face fewer challenges obtaining credit. Their financial and operational challenges vary from those of startups, as these firms are more affected by inflation and supply chain issues.

- Some startups hire employees within their first 2 years in business. In many ways, these firms are similar to startup nonemployers in that they are far less profitable than more established firms. However, startup employer firms have the most pronounced financial challenges and are far more likely than other firms to report issues paying operating expenses. Their credit outcomes are better than nonemployers, but considerably worse than those of older employer firms. Those older employer firms, in contrast, are more profitable, less reliant on personal funds, and have more success obtaining financing.

Suggested Citation

“2023 Report on Nonemployer Firms: Findings from the 2022 Small Business Credit Survey.” 2023. Small Business Credit Survey. Federal Reserve Banks. https://doi.org/10.55350/sbcs-20230531

The views expressed here are those of the authors and not necessarily those of the the Federal Reserve Banks. Data used in this report may be subject to updates or changes.