Findings from a Survey of Small Business Resource Organizations

What did small business resource organizations have to say about recent trends and conditions for small businesses? This report takes a closer look.

The views authors express here are theirs and not necessarily those of the Federal Reserve Banks or the Board of Governors of the Federal Reserve System.

Introduction

This spring, the Federal Reserve Banks conducted a survey of small business resource organizations on recent developments and changes in conditions in the prior six months. Questions focused on changes in small business optimism and challenges, changes in organizations’ capacity and demand for their small business services, and emerging issues. Regarding business optimism and challenges, organizations were asked to respond based on their interactions with the small businesses they serve.

Findings from this survey supplement what small businesses share directly about business and credit conditions in the Federal Reserve’s annual Small Business Credit Survey (SBCS) conducted each fall.

The survey was open from April 7 to April 17, 2025, and collected responses from 143 organizations across the country. As shown in Figure 1, these included Chambers of Commerce, industry associations, community development organizations, state and local government agencies, Small Business Development Centers, and similar entities.

*Examples of “other” organization types include small business accelerator, investor network, entrepreneur ecosystem builder, and university-backed business incubator.

Findings

Changes in small business outlook

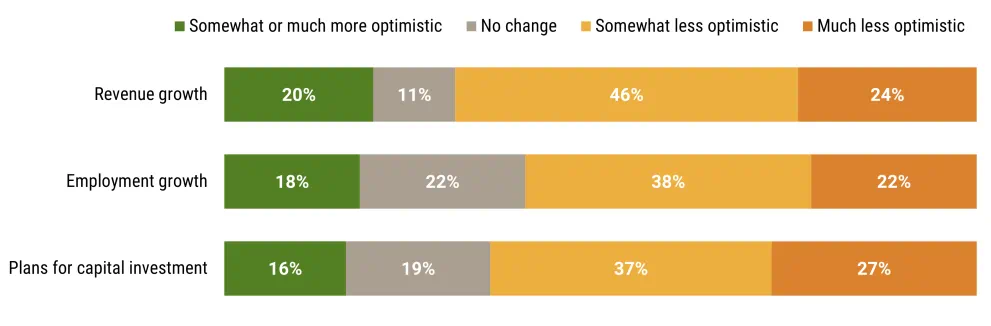

Respondents were asked to characterize recent changes in optimism among the small businesses that their organization serves. As shown in Figure 2, organizations said that small businesses were considerably less optimistic at the time of the survey than they had been six months earlier. Over half of organizations reported that small businesses were either somewhat or much less optimistic about their prospects for revenue and employment growth and their plans for capital investment.1

Notes: “Much more optimistic” and “somewhat more optimistic” are combined in the chart for readability. Response option “unsure” not included. Totals may not sum to 100 because of rounding.

In open-ended comments, respondents indicated that small businesses were most concerned about tariffs, rising prices, and general economic uncertainty leading to weaker demand. They reported that the uncertain economic climate had caused businesses to delay plans for capital investments. A few respondents noted that businesses expressed concern about losing federal contracts and about changes to policies that could limit contract opportunities, especially for minority-owned businesses.

Changes in challenges faced by small businesses

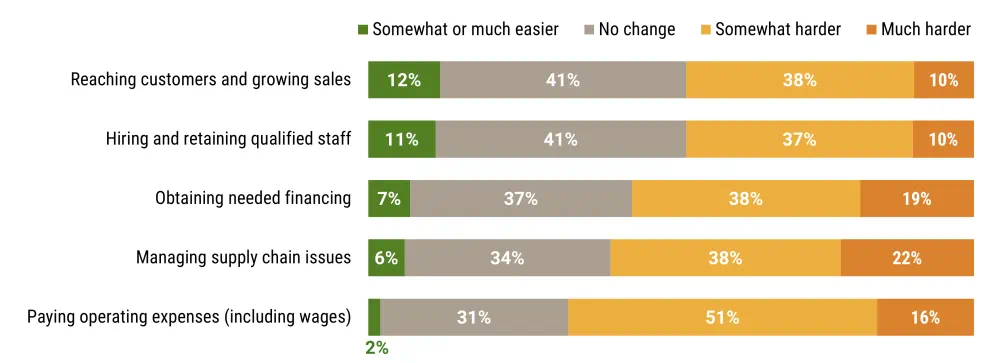

When asked about changes in the intensity of challenges faced by the small businesses in their networks, respondents described a more challenging environment compared to six months before. In particular, a majority of organizations said businesses were finding it more difficult to pay their operating expenses, manage their supply chains, and obtain financing (Figure 3).

Notes: For readability, “much easier” and “somewhat easier” are combined in the chart. Response option “unsure” not shown. Totals may not sum to 100 because of rounding.

In their comments, organizations relayed anecdotes about the challenges they saw affecting the small firms they serve. These included weaker consumer demand, managing supply chains and operating costs (especially those associated with tariffs), and tighter lending standards reducing credit availability. Several also cited hiring challenges related, in part, to changes in immigration policies and a resulting reduction in the availability of workers.

Changes in demand for small business services and responding organizations’ capacity to meet needs

Survey respondents—whose organizations provide a wide range of services to small businesses, including technical assistance, facilitating networking among peers, funding opportunities, and education—described increasing pressures. Overall, respondents indicated that it had become somewhat more difficult for their organizations to support small businesses. They reported that demand for services had increased, while some organizations said they were facing capacity constraints.

![Figure 4. How Has Demand for Your Organization’s Small Business Services Changed in the Past Six Months? [and] How Has Your Organization’s Capacity to Serve the Needs of Small Businesses (For Example, Staffing or Funding) Changed in the Past Six Months? (N=143)](/-/media/project/clevelandfedtenant/fsbsite/analysis/2025/2025-survey-of-business-resource-organizations/figure-4-demand-and-capacity.png?extension=webp&w=991&hash=2660B4CE36A1AABE151D5D213B8A9E0D)

Note: Response option “unsure” not shown. Totals may not sum to 100 because of rounding.

In their comments, respondents noted capacity challenges associated with filling open positions at their organizations and competing with for-profit employers for workers. Several also cited recent or anticipated declines in funding, especially related to government program cuts. Demand for services was seen as rising in a few areas, including support for businesses in managing higher expenses, credit access, and regulatory compliance, and assistance with contracts and litigation. A small number of organizations said they had expanded their capacity in response to the increased demand.

Themes in Respondent Comments

The survey posed several optional open-ended questions, enabling respondents to provide details about the experiences of their organization and the businesses they serve. The summaries below focus on the issues and challenges facing small firms, which comprised the vast majority of responses. A small minority of respondents shared positive sentiments. These comments noted a rise in small business starts, optimism about future growth, and improvement in the credit environment.

Rising costs and tariffs

Respondents relayed that small business owners were concerned about rising costs of materials and the effects of trade policy on their ability to import, and in some cases export, goods. Tariffs on China and Canada were of particular concern to the businesses they serve. One respondent noted a decline in Canadian tourism to the United States affecting small businesses in the border region.

According to responding organizations, pandemic-era supply chain issues had mostly resolved; however, new tariffs had renewed supply chain concerns. Comments noted that small businesses differ from large ones in that the former are unable to stockpile materials as a hedge against higher costs resulting from tariffs. Comments also indicated that, unlike large firms, small businesses do not have the leverage to negotiate favorable terms or the resources to identify new suppliers quickly.

According to comments from numerous respondents, small business owners were finding it difficult to plan because of the uncertain impact of tariffs on supply chains and on inflation, and some firms had put capital investment on hold as a result. Respondents reported that the prospect of tariffs and associated rising costs had dampened small business optimism.

In addition to expected cost increases resulting from tariffs, respondents mentioned other drivers of higher operating costs for small businesses, including wages, insurance, taxes, rent, and utilities. Profit margins were reportedly narrowing at businesses affected by higher costs, and a couple of comments flagged concerns about business survival.

Economic uncertainty

Economic uncertainty was said to be affecting small business optimism in two principal ways: weakening consumer spending and interfering with business planning and investment decisions.

Respondents said that tariff policy was just one of several concerns that were weighing on consumer sentiment about the economy. Volatility in the stock market, recession fears, and higher costs resulting in less disposable income were also said to be contributing to weak consumer sentiment and lower spending levels.

Numerous comments noted that small businesses attributed softening demand for their products and services to reduced consumer spending. Some suggested that weak revenue growth was exacerbating financial challenges for small businesses. In communities with significant immigrant populations, respondents indicated that concerns about immigration enforcement had resulted in lower demand at small businesses as individuals limited their activity to only essential movements.

Many respondents remarked on the impact of general economic uncertainty on business investments. Their comments suggested that small businesses, faced with uncertainty about future growth prospects, were pausing expansion plans.

Federal spending cuts

Respondents cited numerous federal spending reductions that were affecting or were expected to affect small businesses. They described both direct and indirect effects, noting that canceled federal contracts were resulting in revenue losses for both small businesses and their clients. Some respondents reported that payment was delayed or funds were withheld on federal contracts that had already been executed.

Women-, minority-, and veteran-owned firms were said to be anticipating challenges securing new contracts or grants that had previously been more readily available. Some respondents commented that federal contract opportunities were expected to be more limited in general as a result of policy changes.

The impact was reportedly more acute in communities with a large federal agency presence and in certain industries. For example, one respondent remarked that, in a community with a strong Department of Defense presence, spending cuts would affect the contractors and subcontractors that make up a large portion of the local economy. Another respondent noted concerns about impacts from a feared closure of a local Veterans Affairs hospital. Separately, several respondents cited issues in food-related businesses that stemmed from federal spending cuts, and one reported that some businesses were facing potential bankruptcy.

Tightening of lending standards

Challenges with access to credit and capital were among the top issues raised by respondents, who said that access to affordable credit for small businesses had declined in recent months. Banks, credit unions, and Community Development Financial Institutions (CDFIs) were noted as either tightening their underwriting standards, increasing requirements, or delaying approvals. Minority-owned and startup businesses were mentioned as having unmet credit needs. One respondent commented that small businesses were turning to out-of-state banks or to nontraditional products like factoring or invoice financing. Additionally, a couple of comments relayed concerns about small businesses turning to what they termed “predatory lenders.”

Many commenters reported that borrowing costs had increased across a range of products. Several noted that lenders were raising interest rates for small business borrowers, and one noted higher fees for Small Business Administration loans.

Additionally, respondents identified factors affecting small business credit demand. One commented that some businesses are still trying to overcome debt from the pandemic (especially debt from federal Economic Injury Disaster Loans), and another remarked that immigrant business owners were afraid to seek capital. Conversely, a few commenters noted increases in credit demand, including an increase in new loan applications and ongoing needs for startup capital.

Hiring workers

Hiring and retaining workers had been a challenge for small businesses for a number of years, as mentioned by several respondents. They described issues with both recruitment and retention, noting that workers expected higher wages than small businesses were able to pay. Several attributed these expectations, in part, to rising costs of living, including housing and childcare specifically. Some respondents relayed that small businesses were struggling to keep pace with wages and benefits offered by larger firms.

Against this backdrop, multiple respondents said that changes to immigration policy were exacerbating a shortage of workers in some areas. They mentioned food service and agriculture as sectors that were particularly impacted. One commenter noted that immigration enforcement had led to employee fears about reporting to work.

Uncertain policy and regulatory environment

Organizations that serve diverse firms reported fielding concerns from members about executive orders addressing diversity, equity, and inclusion programs. Multiple entities noted the potential impact on opportunities for small businesses, and especially minority-owned firms, to secure contracts with federal, state, and local governments and with the private sector.

Several comments noted that the rapid pace and unpredictability of policy changes at the federal level contributed to small businesses’ weakening sentiment and inability to plan. Respondents identified a number of specific policy and regulatory uncertainties that have emerged as concerns for the small businesses they serve. These include changes to tax policy, labor laws, health regulations, and initiatives at several federal agencies including the Small Business Administration, the Department of Agriculture, and the Department of Defense. One respondent remarked that cuts at the Federal Trade Commission could affect enforcement of the Robinson–Patman Act.2

Impacts on organizations

Many organizations reported both increased demand for their small business services and reduced capacity to meet these needs. Small businesses were seeking additional support from these organizations in several areas, including navigating economic conditions, adapting to changing tariff policy, and securing financing amid tightening credit standards. Several respondents described increased demand for assistance to startup businesses.

Respondents indicated that reduced capacity was primarily the result of decreased funding. Recent funding reductions, along with anticipation of future funding cuts, were common among respondent organizations, especially among those serving diverse businesses. Funding sources that were reported to be under threat included both direct governmental grants and indirect support provided through intermediaries that receive funding through governmental sources. One respondent explained that their funding cut occurred because the organization’s primary funder changed their own funding strategy in response to evolving federal policy. Another organization said they were already facing a downshift in planned services because of the wind-down of pandemic-era funds like those provided by the American Rescue Plan Act (ARPA), which had compounded the challenges some organizations were facing.

Respondents raised specific concerns about continued federal support for technical assistance programs, Small Business Development Centers, Women’s Business Centers, and CDFIs. Some Chambers of Commerce reported reduced fee income due to a downtick in membership.

Organizations described multiple factors affecting their ability to adequately staff to meet demand. Multiple respondents reported losing workers or having difficulty hiring qualified staff. A few attributed this challenge to competition from the private sector for workers. Some respondents reported holding off on hiring as they waited for more certainty about federal policy and funding sources.

Looking Ahead

As small businesses navigate changing conditions, resource organizations reported adapting their practices to meet the evolving needs of their networks. In their survey comments, respondents mentioned specific steps they were taking to address emerging challenges for the businesses they serve, even as many of these organizations faced their own challenges with respect to funding and capacity. Several comments highlighted efforts to connect business owners with resources, including service providers, lenders, or other local small businesses for peer learning and business-to-business supply chain opportunities. Respondents described tailored programs they had created—for example, one to help small business owners navigate the changes in global trade and another to guide new entrepreneurs. Others mentioned the work that their organizations had underway to improve the talent pipeline and to strengthen the small business ecosystem.

In light of resource constraints, some organizations reported pursuing opportunities to do more with less. A few respondents mentioned the value of partnering with other local entities to share knowledge and expertise and to develop joint programs or services. Artificial intelligence (AI) was mentioned by a couple of respondents as an opportunity for organizations and small businesses to improve efficiency and reach. Still, the cost and limited understanding of new technologies were reported to be primary barriers to increased adoption.

In response to a question about opportunities for the Federal Reserve, organizations emphasized the importance of providing data on economic and business conditions, including from the SBCS. Detailed data on the experiences of different types of small businesses—as provided in the Firms in Focus chartbooks—were seen as particularly useful. Respondents also underscored the importance of the Federal Reserve’s continued community engagement, including through convenings on emerging issues affecting small businesses.

This fall, the Federal Reserve will again field the SBCS to gather insights on small businesses’ experiences and challenges. Small business owners are encouraged to provide their perspectives, and small business resource organizations are invited to partner with the Federal Reserve by sharing the survey with their networks.

Footnotes

- On April 9, a few days into the fielding of the survey, the administration announced a 90-day pause on most of the tariffs that had been introduced on April 2. The quantitative responses collected after the announcement were somewhat more pessimistic than those collected before. Return to 1

- The Robinson–Patman Act (1936) is a US antitrust law prohibiting price discrimination, particularly by large franchises and chains against small businesses. Return to 2

This work is licensed under Creative Commons Attribution-NonCommercial 4.0 International