All Survey Years

The Small Business Credit Survey is a national sample of small businesses, or firms with fewer than 500 employees, aimed at providing insight into firms' financing and debt needs and experiences. Analysis of this dataset is issued through a series of reports.

2024 Reports from the 2023 Small Business Credit Survey

2024 Firms in Focus chartbooks on small business data

These 43 chartbooks help researchers easily compare small business data. They break down the data from the Federal Reserve’s 2023 Small Business Credit Survey by business characteristics, owner demographics, and geographic location (states and metropolitan statistical areas).

2024 Report on Employer Firms

Firm revenue and employment growth held mostly steady between 2022 and 2023 but lagged prepandemic levels. Application rates for financing declined, and approvals remained little changed.

2023 Reports from the 2022 Small Business Credit Survey

2023 Report on Startup Firms Owned by People of Color

Startup firms owned by people of color were more likely than white-owned startups to expect to add employees in next year but less likely to be approved for financing.

2023 Report on Nonemployer Firms

Nonemployer firms are less likely to be profitable than their employer firm counterparts, and they face more substantial challenges accessing credit.

2023 Firms in Focus

Firms in Focus is a series of chartbooks presenting Small Business Credit Survey data across various business and owner demographic characteristics, as well as by state and metropolitan statistical area (MSA).

2023 Report on Employer Firms

Small business revenue, employment, and profitability each improved from 2021, but expectations worsened year-over-year. With the end of pandemic-related funding programs, the application rate for traditional financing rebounded to prepandemic levels.

2022 Reports from the 2021 Small Business Credit Survey

2022 Report on Employer Firms

Revenue and employment improved for small businesses since 2020, but performance largely lags prepandemic levels. Financing approval rates continued to trend lower than in years prior to the pandemic.

Clicking for Credit: Experiences of Online Lender Applicants from the Small Business Credit Survey

The 2021 Small Business Credit Survey revealed much about small businesses that sought credit from an online lender instead of a bank.

2022 Report on Nonemployer Firms

Most businesses with no employees other than the owner earned lower revenues in 2021 than they did before the pandemic. These nonemployer firms continued to be less likely than employer firms to seek pandemic-related financial assistance.

2022 Report on Firms Owned by People of Color

Businesses owned by people of color faced more financial and operational challenges than their white-owned counterparts and often were less successful at obtaining the funding needed to weather the effects of the pandemic.

2022 Report on Hiring and Worker Retention

Seventy-five percent of employer firms tried to hire workers in 2021; close to half called the experience "very difficult." In response, firms most often increased wages or shifted more work to existing employees.

2022 Firms in Focus

Firms in Focus highlights SBCS findings across different demographic groups of small businesses, allowing anyone who’s interested to better understand the full landscape of small businesses.

2021 Reports from the 2020 Small Business Credit Survey

2021 Report on Firms Owned by People of Color

Firms of color were more likely to experience financial and operational challenges stemming from the pandemic. These challenges are particularly salient given the important role business ownership plays in wealth building and employment in communities of color.

2021 Report on Nonemployer Firms

Businesses with no employees other than the owner often turned to personal funds in response to financial challenges during the pandemic. These nonemployers were less likely than employer firms to seek pandemic-related emergency funding and less likely to be approved.

2021 Report on Employer Firms

Small businesses continue to face significant challenges amid the COVID-19 pandemic, including weak demand, heightened expenses, and limited credit availability. Nearly one-third of firms say they’re unlikely to survive without additional government aid until sales recover.

2020 Reports from the 2019 Small Business Credit Survey

Double Jeopardy: Covid-19’s Concentrated Health and Wealth Effects in Black Communities

Counties with the highest density of COVID-19 cases are also areas with the highest concentration of Black businesses and networks. Our analysis shows stark PPP coverage gaps in these hardest hit communities.

Can Small Firms Weather the Economic Effects of Covid-19?

We examine how firms are likely to weather the impacts of COVID-19 by unpacking small firms’ financial resiliency. Most firms would need to take significant cost-cutting measures or borrow if faced with sustained revenue loss.

2020 Report on Employer Firms

Fielded in Q3 and Q4 of 2019, the SBCS offers baseline data on the financing and credit positions of small firms before the onset of the crisis. We find that while banks are the most broad-reaching lending channel, many small businesses do

2019 Reports from the 2018 Small Business Credit Survey

2019 Report on Employer Firms

Heading into 2019, small businesses with payroll employees reported stronger revenue and employment growth and continued levels of credit demand, with more firms applying to online lenders for financing.

Click, Submit 2.0: An Update on Online Lender Applicants From the Small Business Credit Survey

Though they represent a small share of total small-business lending, nonbank online lenders are a growing source of small-dollar credit for small businesses.

2019 Report on Nonemployer Firms

Despite being a key income source for their owners, nonemployer firms face acute profitability and financing challenges.

2019 Report on Minority-Owned Firms

Many minority-owned small businesses faced financial challenges and lagged in key performance indicators for profitability, revenue growth, and employee growth.

2018 Reports from the 2017 Small Business Credit Survey

2017 Small Business Credit Survey Report on Employer Firms

Heading into 2018, small businesses with employees reported stronger revenue growth and profitability, but some segments of firms continued to face financial challenges.

2018 Report on Nonemployer Firms

Nonemployer firms make up 81% of all U.S. small businesses, generating $1.2 trillion in annual sales. But are they succeeding financially?

How Do Firms Respond to Hiring Difficulties? Evidence from the Federal Reserve Banks' Small Business Credit Survey

Two-thirds of small businesses report hiring challenges. We look at the different difficulties they face and how they solve for them.

2017 Small Business Credit Survey Report on Disaster-Affected Firms

Forty percent of firms in FEMA-designated disaster areas reported losses from recent storms. We examine which firms were hit hardest and how heavily they depend on aid and credit to get back in business.

2017 Reports from the 2016 Small Business Credit Survey

2016 Small Business Credit Survey Report on Employer Firms

While many small businesses with employees were profitable and optimistic in 2016, a significant majority faced financial challenges, experienced funding gaps and relied on personal finances.

2016 Small Business Credit Survey Report on Minority-Owned Firms

Minority-owned small businesses face more financial challenges and funding gaps than nonminority firms.

2016 Small Business Credit Survey Report on Microbusinesses

Microbusinesses, or nonemployers and small businesses with four or fewer employees, account for about 9 in 10 U.S. firms.

2016 Small Business Credit Survey Report on Rural Employer Firms

How do rural small businesses compare with their urban counterparts?

2016 Small Business Credit Survey Report on Startup Firms

Startups, or small businesses that were 5-years-old or younger in 2016, reported stronger growth and more optimism than mature firms, but have greater credit risk and experience more financial challenges.

2016 Small Business Credit Survey Report on Women-Owned Firms

Women-owned small businesses make up 20 percent of all small employer firms and are a growing segment of U.S. businesses. Is there a gender gap between them and small businesses owned by men?

2016 Reports from the 2015 Small Business Credit Survey

2015 Small Business Credit Survey Report on Employer Firms

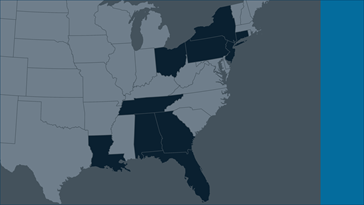

In 2015, seven Reserve Banks collaborated on a survey of small business owners to gather perspectives on regional business conditions and small firms financing needs.

2015 Small Business Credit Survey Report on Nonemployer Firms

In 2015, seven Reserve Banks collaborated on a survey of small business owners to gather perspectives on regional business conditions and small firms financing needs.

2015 Reports from the 2014 Small Business Credit Survey

2014 Joint Small Business Credit Survey Report

A Joint Credit Survey was conducted by several Reserve Banks in 2014 to learn about small business conditions and financing needs.